France is set to pass a new energy law slashing the country’s renewable energy targets and expanding nuclear power production, p...

Bannerman Energy has executed a landmark binding investment subscription and joint venture documentation with CNNC Overseas Limite...

Paladin Energy, which owns a 75% share in the Langer Heinrich Mine (LHM) in Namibia, has announced strong operational performance ...

France Slashes Renewable Energy Targets, Expands Nuclear Power with New Law; https://t.co/ZGbhlSLxSu #NuclearEnergy #NuclearPower #CleanEnergy

— TradeTech (@U3O8TradeTech) February 12, 2026

Jun 7, 2022 – TradeTech President Treva Klingbiel Joins WNFM Panel Discussion

Jun 7, 2022 - TradeTech President Treva Klingbiel Joins WNFM Panel Discussion

TradeTech President Treva Klingbiel joined a high-level panel of nuclear utility and uranium mining executives during the 48 th annual World Nuclear Fuel Market conference in Montreal, Canada, on June 7, where the discussion focused on strategies to manage the new paradigm in today's nuclear fuel market.

Apr 27, 2022 - TradeTech President Treva Klingbiel Moderates WNFC Session: Uranium Mining – Today & Tomorrow

TradeTech President Treva Klingbiel served as the moderator for a session during the World Nuclear Fuel Cycle conference in London on April 27, 2022, which focused on uranium mining in today’s market and the challenges that lie ahead.

Nov 3, 2021 - TradeTech President Treva Klingbiel Presents "Global Uranium Market & Fundamentals" for the 57th Meeting of the Joint OECD/NEA-IAEA Uranium Group Meeting

As the global energy mix shifts, and nuclear power makes its case as a source of carbon-free baseload power, the international nuclear fuel cycle industry will continue to face its unique challenges, some enduring and some temporary, TradeTech President Treva E. Klingbiel noted during a presentation for the OECD/NEW-IAEA joint virtual meeting today.

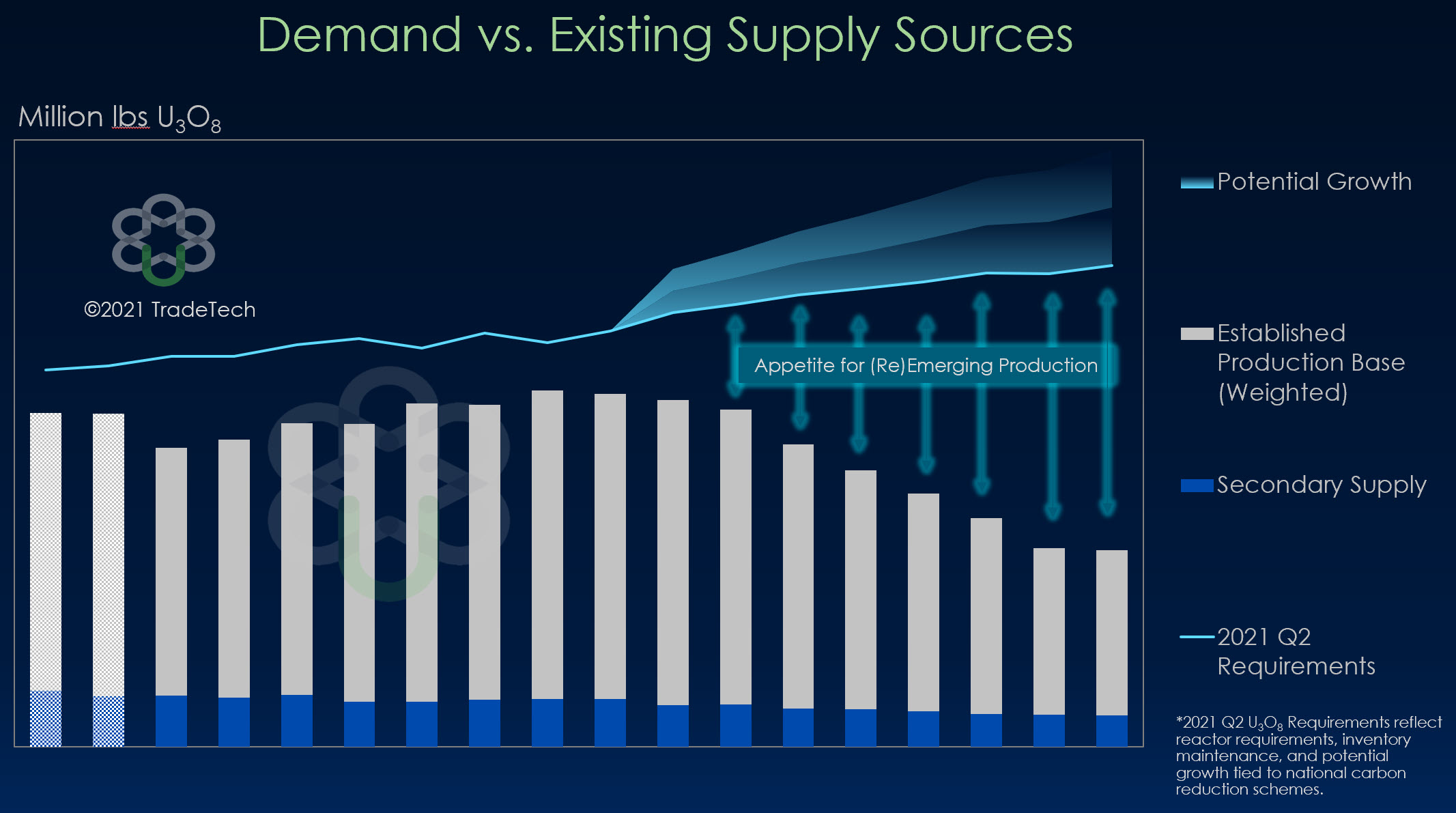

Spot uranium prices have reached historical levels of volatility recently, owing largely to buying by producers and funds such as the recently launched Sprott Physical Uranium Trust (SPUT). "One of the reasons for the recent rise in spot prices is a widespread recognition that a fundamental structural supply deficit exists in the uranium market," Klingbiel noted.

Given the current global sentiment and recognition around the need for nuclear to be a part of the energy mix, higher demand for uranium could come into play as early as 2024, reflecting a much more positive outlook concerning Japanese reactor restarts, expansion in France, and in the UK for instance. On the supply side, there is a clear supply gap, which is rooted in the reduced revenues among many suppliers that impacted investment into the development of future supply in the post-Fukushima period. And, new interest from Yellow Cake plc, SPUT, and many other newly minted physical holding companies has compounded the deficit. "This sizable gap between the availability of primary production derived from existing mines, versus the need for new production as defined by both existing and forward-looking requirements, highlights my key message today. We can see that the world needs new uranium mines to be commissioned in the first half of this decade. And our analysis tells us that the evolving deficit between supply and demand requires that new uranium production be under construction in the first half of the decade," Klingbiel stated.

Uranium producers and developers will continue to reduce costs, optimize their production, and innovate in an effort to increase their competitiveness relative to their peers. The demand side will innovate as, well, especially now that supportive policies are emerging in light of carbon-reduction goals. And, the uranium market likely continue to see the investment community take various positions, some short-term and some long-term, some capitalizing on the supply deficit, as with Yellow Cake plc and SPUT, and some on the demand side, with investments in newer generating technologies. [top]

Feb 4, 2021 - TradeTech President Treva Klingbiel Presents “Investing Beyond Today’s Impasse” for Shaw and Partners Uranium Conference

While prevailing uranium price levels might best be characterized as sentiment-driven, the prevailing sentiment for some time in the market has been uncertainty, TradeTech President Treva Klingbiel said during a presentation for the Shaw and Partners Uranium Conference today.

However, there is reason for optimism. Today, the number of nuclear reactors under construction globally is 52. Combined with existing reactors in operation today, this equates to nearly 19,000 reactor-years of operation. The number of new uranium mines under construction today is zero. Consequently, “the world does need new uranium mines, and the necessity for nuclear utilities to maintain a diverse supply portfolio has rarely been more critical than it is today,” Klingbiel noted.

Disruptive times tend to foster greater technological innovation, which will not only contribute to a realignment of costs and prices, but help secure uranium supply well into the future. “Technology and innovation represent a viable conduit for the uranium production sector to develop and implement new approaches and processes to realize mineral resource opportunities while improving environmental performance and meeting social expectations,” she added. [top]

Jul 13, 2019 - White House: Memorandum on the Effect of Uranium Imports on the National Security and Establishment of the United States Nuclear Fuel Working Group

Overnight, the White House Office of the Press Secretary released a statement on the Trump administration's next move related to the Section 232 investigation into US uranium imports. In a written memorandum, US President Donald Trump did not concur with a US Department of Commerce (DOC) investigation that found uranium imports threaten to impair US national security. Trump wrote that while the findings "raise significant concerns" he was ordering an in-depth review. "A fuller analysis of national security considerations with respect to the entire nuclear fuel supply chain is necessary at this time," Trump stated in the memorandum published late on July 12. He added that the newly formed working group would make "recommendations to further enable domestic nuclear fuel production if needed."

While Trump declined to issue quotas for domestic uranium production, he has ordered a new 90-day review by a group of federal agencies. The Nuclear Fuel Working Group will be chaired by US National Security Advisor John Bolton and US National Economic Council Director Larry Kudlow to examine the entire nuclear fuel cycle and "develop recommendations for reviving and expanding domestic nuclear fuel production."

President Trump took the full 90 days to formally address the DOC findings related to the Section 232 investigation, which followed a Section 232 Petition filed with the Department in January last year by US uranium producers Energy Fuels and Ur-Energy. Section 232 of the Trade Expansion Act of 1962 authorizes the President of the United States, through tariffs or other means, to adjust the imports of goods or materials from other countries if it deems the quantity or circumstances surrounding those imports to threaten national security. Upon receipt of the final report, the President may take a range of actions, or no action, based on the Secretary of Commerce's recommendations provided in the report. [top]

In a presentation entitled, "A Cointegrated Approach to an Evolving Supply & Demand Dynamic," Plummer explored the sustainability (or unsustainable nature) of future uranium supply as today's low market prices present difficult circumstances for producers and developers. He explained that the economics of a mine underpin its competitiveness. As such, costs, in one form or another, are among the most important dimensions that drive the uranium production industry. He noted that despite that fact, mining costs are one of the least understood aspects of the nuclear fuel industry.

Although lower U3O8 prices have forced producers to suppress their cash costs, rising indirect costs and net interest charges are beginning to affect the full-cost of production for some companies. As a result, the growing gap between C1, C2, and C3 costs can erode a miner's revenue stream.

Despite the successful lowering of cash mining costs, the ability to reduce indirect and overhead charges is largely beyond the control of the mining companies themselves. Dimensions that were once perceived to be less important than costs are now innately linked to the strength of an operation. Socio-economic, geopolitical, regulatory, environmental, and macro-economic parameters, known as Modifying Factors in TradeTech's model, demand equal attention when evaluating the strength of a uranium project. (TradeTech uses geological constraints and modifying factors in conjunction with its Asset Viability Rating system to quantify how sensitive each pound of uranium is to cost pressures in the future. [top]