The International Energy Agency’s (IEA) Energy Mix newsletter reports that the IEA is continuously assessing the energy security...

US-based advanced reactor designer Oklo and Centrus Energy have announced plans to form a joint venture to expand nuclear fuel ser...

Denison Mines has started a 2026 winter drilling program at the Wheeler North joint venture in Saskatchewan’s Athabasca Basin, t...

NexGen Energy has obtained the final federal approval for its Rook I Uranium Project, having received a license to prepare site an...

USA: Oklo, Centrus Announce Planned Joint Venture to Advance Nuclear Fuel Services in Ohiohttps://t.co/Ku8GdpzVss#nuclearpower #nuclearenergy #CleanEnergy #nuclearfuel

— TradeTech (@U3O8TradeTech) March 9, 2026

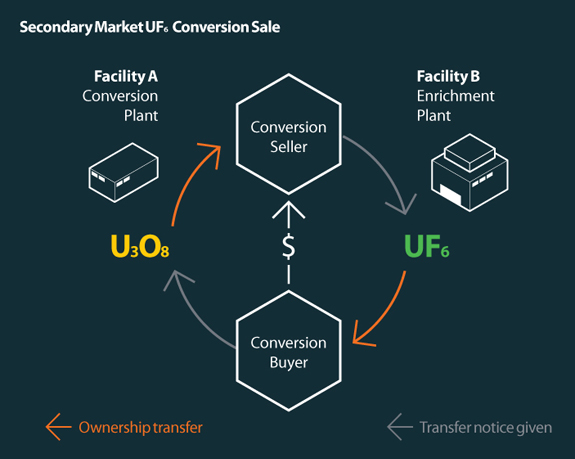

Uranium 101 - Uranium Contract Pricing