Today, the Canadian Nuclear Safety Commission (CNSC) announced its decision to issue a license to Denison Mines Corp. to prepare a...

In a significant move to assert its financial independence and capitalize on its vast natural resources, the government of Niger h...

Denmark-based advanced reactor developer Copenhagen Atomics has signed a letter of intent with Rare Earths Norway to secure future...

Canada: Commission Issues a License to Denison Mines Corp. Authorizing Site Preparation and Construction of its Wheeler River Projecthttps://t.co/9R9U3exCHB#NuclearEnergy #NuclearPower #CleanEnergy @DenisonMinesCo @CNSC_CCSN

— TradeTech (@U3O8TradeTech) February 19, 2026

December 9, 2025 – TradeTech President Treva Klingbiel Joins Panel at Global Uranium Equity Summit

September 9, 2025 – TradeTech President Treva Klingbiel Speaks to JPMorgan Audience

March 21, 2025 – White House Executive Order Aims to Boost US Minerals Production

January 10, 2025 – TradeTech "Spotlight Interview" with Radiant

March 25, 2024 – TradeTech’s Treva Klingbiel Participates in enCore Energy’s Inaugural Investor Day

March 21, 2024 – Bloomberg: Uranium’s 22% Price Plunge Is Bottoming Out on Nuclear Future

December 9, 2025 - TradeTech President Treva Klingbiel Joins Panel at Global Uranium Equity Summit

TradeTech President Treva Klingbiel spoke at the 3rd Annual Global Uranium Equity Summit in New York City hosted by Canadian investment bank Canaccord Genuity on December 9. The meeting included a panel discussion of current issues in the nuclear fuel market led by Canaccord Genuity Analyst Katie Lachapelle.

Klingbiel opened the discussion with a market overview, identifying several challenges and opportunities facing buyers and sellers, including a structural supply deficit, new demand, and increased investor interest. The panel also featured Mike Akin, Sachem Cove Partners; John Ciampaglia, CFA, FCSI, Sprott Asset Management/Sprott Physical Uranium Trust; Giordano Morichi, Terra Innovatum - SOLO, and Cory Kos, Cameco Corporation.

November 7, 2025 - TradeTech President Treva Klingbiel Provides Keynote Address for Global Uranium Conference 2025

TradeTech President Treva Klingbiel provided the keynote address for the Global Uranium Conference in Adelaide, Australia on October 21, 2025, which offered a look at today’s global uranium market.

Electricity demand, driven by Artificial Intelligence (AI) specifically, is expected to place significant demand on nuclear power globally, with increases in demand foreshadowed by the pace of innovation and evolution in both the information technology and industrial sectors. As a result, the nuclear fuel cycle industries are challenged by the speed at which they can react to policy changes, and in turn, how quickly both the supply and demand sectors can respond to each other.

Moreover, unpredictable and evolving trade policies this year have led to volatility in equity markets. This has impacted several industries, including the nuclear power and uranium mining sectors, which has been reflected in increased uranium price volatility.

When reviewing the recent uranium price cycle, Klingbiel commented, “We believe our market is going to experience accelerated cycles going forward, and that we will see both large-scale and mini cycles, driven primarily by trade policies and energy demand associated with the information technology sector.”

A notable growth sector within the nuclear power industry is the emerging market for small modular reactors (SMRs). Five years ago, SMRs were not expected to gain much traction until 2030, however, today there are several nations that are moving much more quickly with project development. SMR projects in the USA, UK, and Canada, for instance, are advancing through design and regulatory approvals at an accelerated pace with plans for demonstration plants already outlined.

Klingbiel told the audience that SMRs provide relatively “small” financial risk while promising flexibility in a multitude of applications. “TradeTech see SMRs as the future standard bearer for the industry—similar to what AI has done for the technology sector. SMRs are drawing in financial interest and support in anticipation of exponential advancements in the future,” she said.

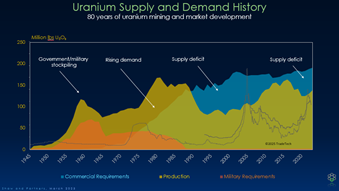

With increasing demand on the horizon, TradeTech’s analysis shows that the evolving deficit between supply and demand requires new uranium production well before 2030, and that need grows significantly. And, while recent geopolitical developments have led to substantial efforts to diversify supply sources, the number of active producers today has consolidated to the point where six companies contribute nearly 75 percent of global supply, and three of those companies contribute one-half of global supply.

However, there is a field of emerging suppliers that is growing in tandem with the recent rise in uranium prices. “As prices exceed production costs and near incentive prices, several emerging suppliers are queued at their respective pre-construction final investment decision stages. Approximately 23 emerging producers are positioned to produce up to 50 million pounds U3O8 by 2030,” Klingbiel noted. [top]

September 9, 2025 - TradeTech President Treva Klingbiel Speaks to JPMorgan Audience

TradeTech President Treva Klingbiel spoke about today’s uranium market during an event hosted by JP Morgan on September 9, 2025.

The recent World Nuclear Association (WNA) Symposium in London promoted the organization’s ambition of “Tripling capacity by 2050” as “the bare minimum required,” while an earlier statement from the International Energy Agency noted that global data center electricity consumption could reach around 945 TWh by 2030. To meet this new expected demand, the WNA’s Reference Scenario projects that nuclear capacity will reach 686 GWe by 2040, requiring just over 390 million pounds U3O8 to fuel a growing number of nuclear power plants around the world.

As a result of this new expected demand, the nuclear fuel cycle industries are challenged by the speed at which they can react to policy changes, and in turn, how quickly both the supply and demands sides can respond to each other. While there is great optimism on the demand front, recent developments have highlighted issues on the production side that present a formidable challenge to the industry’s ability to meet the growing demand for nuclear fuel. In particular, global producers Kazatomprom and Cameco Corp. have indicated that their production will be lower in the near term. These production-related developments arose in the wake of increased buying by physical funds such as the Sprott Physical Uranium Trust.

“To meet the goals set forth by the demands of increasing capacity requirements and supportive government policies, the industry must protect existing capacity, and several rounds of recent legislation have been passed in multiple countries to do just that. In the USA, for example, we’ve witnessed a notable change in government policies, with support shifting from net-zero carbon reduction programs to energy independence and energy dominance,” Klingbiel explained.

Klingbiel also noted that nuclear plant license extensions and reactor power uprates are key to preserving nuclear power capacity to fuel electricity demand today and in the future. “For instance, to date in the USA, license extensions have preserved more than 94 GWe of nuclear generating capacity. Uprates and refurbishments have added approximately 8 GWe of additional generating capacity and recommissioning efforts could re-introduce another 3 GWe of generating capacity to the US fleet,” she said.

TradeTech’s analysis shows that the evolving deficit between supply and demand requires that new uranium production is required well before 2030, and that need grows significantly. The nuclear industry needs capital and technology to bridge the supply, as well as policy support to provide the legal framework to support investment in nuclear power for the long term, according to the company.

“From prospective uranium miners to advanced technology suppliers, utilities, and fuel suppliers, the financing feedback loop is putting real dollars into the future of nuclear power. And that might be the clearest evidence yet that all the pieces are coming together for nuclear power,” Klingbiel stated. [top]

March 27, 2025 - TradeTech President Treva Klingbiel Presents “Uranium Market Developments and Evolving Policies” for Shaw and Partners Uranium Conference

In early 2025, the global markets have witnessed the upending of long-standing trade relationships, policy positions, and alliances, primarily driven by political developments in the USA. As a result, uranium market prices have evolved to show distinct super cycles, the most recent exhibiting increased volatility, TradeTech President Treva Klingbiel said during the keynote presentation for the Shaw and Partners Uranium Conference, held virtually on March 27.

“One of the challenges faced by the uranium market today is the speed at which the industry can react to policy changes and, in turn, how quickly both the supply and demand sides can respond to each other, Klingbiel explained. TradeTech believes the uranium market is going to experience accelerated cycles going forward, and that the market will see both large-scale and mini cycles, driven primarily by energy demand associated with the information technology sector which itself is one of the fastest-moving areas.

The Executive Order defines “minerals” as not only the those identified as critical on the US Department of Interior’s list, but also adds uranium, copper, gold, and potash. Importantly, it leaves the critical minerals list open to other materials as determined by the newly formed National Energy Dominance Council.

Romania is planning to expand its nuclear power program, including both large reactors (two additional CANDU reactors—Cernavoda Units 3 & 4) and small modular reactors. Nuclearelectrica also plans to extend the operating life of Cernavoda Unit 1 to 60 years.

Mr. Ghita shared his views on various opportunities and challenges confronting the company and also the global nuclear industry. [top]

January 7, 2025 - TradeTech “Spotlight Interview” with Radiant

TradeTech's Nuclear Market Review has featured a “Spotlight Interview” Radiant CEO Doug Bernauer, who highlights the clean energy startup’s nuclear power activities and goals.

The US-based company is building a nuclear microreactor as a climate friendly alternative to diesel generators. Kaleidos, a 1 MW portable microreactor will bring power to remote regions around the world and provide backup power for life-saving applications in hospitals or disaster-relief scenarios. The company plans to test its development reactor by 2026 and, if successful, it will be the first new commercial reactor design in the USA to achieve a fueled test in over 50 years. [top]

December 31, 2024 - TradeTech's Production Cost Indicator Edges Upward with Focus on Newly Emerging Projects in 2025

TradeTech’s monthly Production Cost Indicator (PCI) increased 0.3 percent (US$0.20) to $58.40 per pound U3O8 for December 2024—5.4 percent ($3.00) higher than last year’s equivalent of $55.40 and the highest value since the Indicator’s inception in April 2020.

The December PCI value of $58.40 per pound U3O8 continues to reflect a combination of circumstances affecting the future supply/demand dynamic, especially technical, logistical, regulatory, and macroeconomic factors impacting the production economics of future uranium projects. As the uranium industry transitions into 2025, the PCI cohort will ratchet forward to reflect a nuanced cohort of future projects that is considerably different than the cohort that constituted much of the PCI analysis in 2024.

Chief among the various reasons cited for revising production targets for certain projects downward in 2024 were technical and operational issues. From 2025, with most idled operations restarted and therefore removed from the PCI analysis, the scope of risk narrows its focus on newly emerging projects. Many of those proposed operations are not fully permitted, and none are sufficiently financed to build their operations using cash alone.

From January 2025, the PCI value will reflect the cost and production profiles of (re)emerging uranium projects deemed competitive—and capable—of delivering into a new 2027-2032 window (previously 2026-2031). With respect to the full spectrum of projects now competing in the market from 2025, TradeTech has revisited its assessment concerning the likelihood and the consequences of risk affecting the production schedules and mining economics of future projects.

Editor’s Note: This PCI analysis is abridged from an “In Focus” article published in the December 31, 2024 issue of TradeTech’s Nuclear Market Review. [top]

October 23, 2024 - TradeTech President Treva Klingbiel Welcomed as Keynote Speaker for Global Uranium Conference

TradeTech President Treva Klingbiel opened the Global Uranium Conference in Adelaide, Australia on October 23, 2024, with her presentation entitled “Nuclear Fuel Market Fundamentals: A New Start,” which focused on the key driver of uranium demand today—the growing need for clean energy.

Government policies worldwide have evolved to acknowledge and support nuclear power's critical role in achieving carbon reduction goals. “This support stands as recognition that addressing climate change is an immediate concern, and that nuclear power can and must play a role,” Klingbiel told the audience.

While nuclear power currently accounts for nearly 10 percent of global electricity and roughly 30 percent of low-carbon generation, there is a new category of electricity consumer that is set to increase nuclear power’s share. Hyperscalers, such as Amazon, Google, and Microsoft, are in the business of artificial intelligence, cryptocurrency mining, and other large-scale and electricity-hungry IT applications, which require massive datacenters that rely on vast amounts of uninterrupted power. Additionally, and often overlooked, is that nuclear power is crucial for industrial applications, which are leaders in terms of energy consumption. All of these uses for nuclear support the expanded role of nuclear in tomorrow’s energy markets and make nuclear an attractive investment.

The increasing need for clean energy comes at a time when the availability of uranium production from existing supply sources is under great strain. For example, in addition to the trade restrictions levied on Russian nuclear imports into some of the largest markets, large portions of future production are being claimed by China. “Our analysis shows us that the evolving deficit between supply and demand requires that new uranium production is needed well before 2030, and that need grows significantly, even in the most conservative demand scenario,” Klingbiel explained.

When looking at recent uranium prices, a primary driver behind the latest increase in price is perceptions of a primary supply shortage, threats to deliveries, inflation in predicted production costs, and general uncertainty around the availability of future supply. These fundamental concerns have been amplified by geopolitical and logistical risks. [top]

April 11, 2024 - TradeTech President Treva Klingbiel Highlights Uranium Price Trend & Market Developments in Keynote Address for PI Financial Uranium Investors Forum

In the keynote address for the PI Financial Uranium Investors Forum in Toronto, TradeTech President Treva Klingbiel stated that the spot uranium price has trended upward for the last several years, showing notable volatility along the way, which has reflected the diverse interests, expectations, and externalities at play in the market at particular points in time.

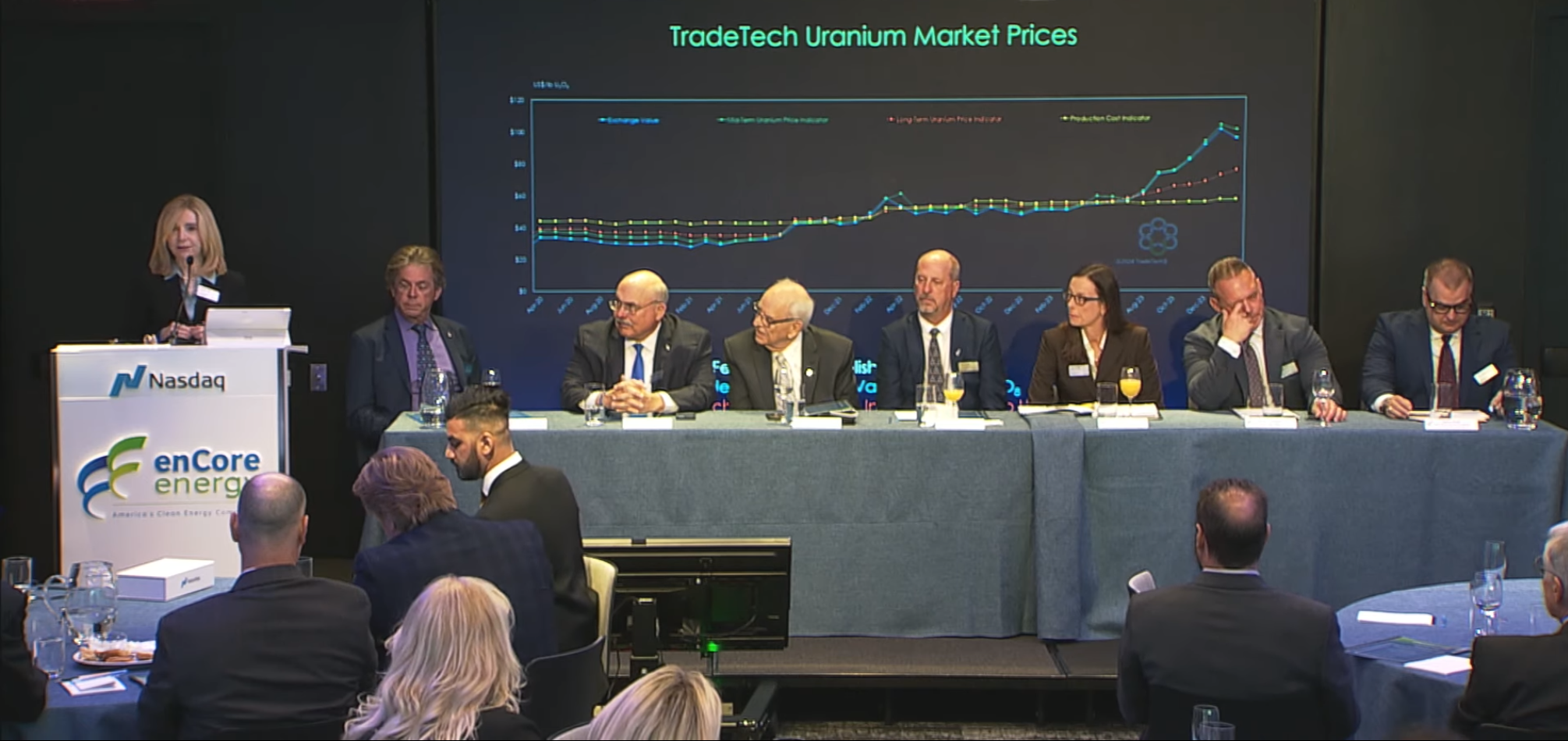

March 25, 2024 - TradeTech’s Treva Klingbiel Participates in enCore Energy’s Inaugural Investor Day

US uranium producer enCore Energy Corp. rang the Nasdaq Opening Bell in New York City on March 25, 2024, which was followed by the company’s first Annual Investor Day.

TradeTech President Treva Klingbiel provided the opening address for the Investor Day event, entitled “Uranium: Fueling the Future.” Her presentation highlighted recent developments and some of the key factors influencing the uranium market, including geopolitical unrest, increasing demand related to climate change initiatives, and uncertainty surrounding Russian nuclear fuel exports, which have increased the attention on domestic and geopolitically friendly sources of uranium supply. enCore Energy’s Investor Day video presentation is available at: https://encoreuranium.com/investor-day/. [top]

March 21, 2024 - Bloomberg: Uranium’s 22% Price Plunge Is Bottoming Out on Nuclear Future

Bloomberg’s Maria Clara Cobo reported on uranium market prices, which despite a 22 percent decline over six weeks, has industry experts and analysts saying that the uranium market has likely set a new floor thanks to a strong demand outlook.

Treva Klingbiel, president of uranium price reporter and industry consultant TradeTech, said she doesn’t see demand for nuclear fuel easing any time soon. “We have a number of geopolitical factors that have a really significant influence on buyer behavior, even though fundamentally nothing has changed” she said. “Buyers can use the spot [market price] to tell them the sentiment of the day but must look at the long-term market to see that it is marching steadily up, it hasn’t taken a hiccup at all." [top]